Selling and Buying at the Same Time? Here's What You Need to Know

Are you a homeowner contemplating a move? One of the biggest questions you're likely asking is: "What comes first – selling my current home or buying the next one?" The answer, of course, is "it depends!" It depends on your unique circumstances, financial situation, and the local market. I'm here to help you navigate this decision and make the best choice for your specific needs.

I understand the local market dynamics, the latest trends, and what's working for other homeowners right now. My expertise allows me to provide personalized recommendations that align with your goals.

(The Case for Selling First)

While there's no one-size-fits-all answer, selling your current home before embarking on your buying journey can often be the most strategic approach. Here's why:

Unlock Your Home Equity: Selling first allows you to access the equity you've built up in your current home. Data from Cotality (formerly CoreLogic) reveals that the average homeowner is sitting on a substantial $302,000 in equity! This equity can be used as a down payment on your next home, potentially even enabling you to buy in cash.

Avoid Juggling Two Mortgages: Trying to buy before you sell can result in the stress of managing two mortgages, even if only temporarily. This can be financially draining, especially if unexpected repairs or delays arise. Ramsey Solutions advises, "It's best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches."

Strengthen Your Offer: Sellers often favor clean, straightforward offers. By selling your current home first, you eliminate the need to make your offer contingent on that sale, giving you a competitive edge in a tight market. We'll work together to craft a compelling offer that maximizes your chances of success.

(Potential Trade-Off: Temporary Housing)

One potential drawback of selling first is the possibility of needing temporary housing between selling your current home and moving into your next. However, I can help you negotiate terms such as a post-closing occupancy (renting the home from the buyer for a set period) or flexible closing dates to minimize any disruption.

(Making the Right Choice)

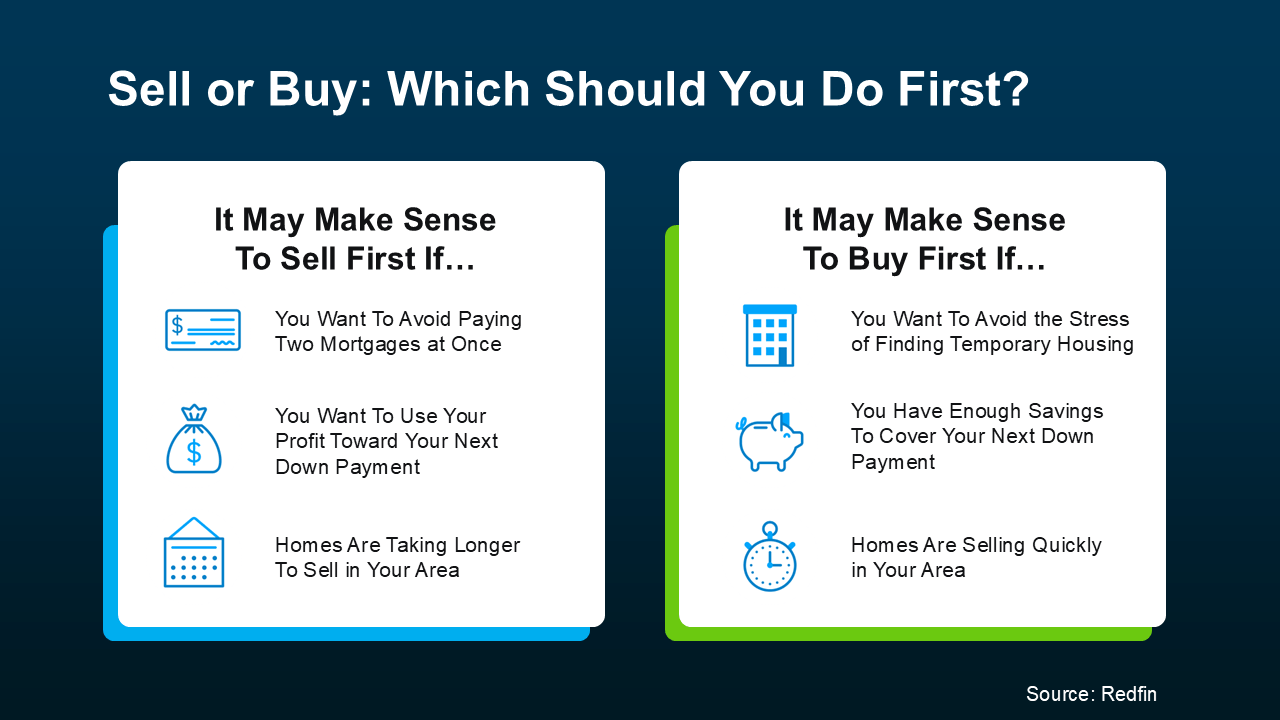

To help you weigh your options, I've included a helpful infographic that summarizes the key factors to consider when deciding whether to sell or buy first:

(The Bottom Line)

As the infographic highlights, there are distinct advantages to both selling first and buying first. Ultimately, the best approach depends on your individual circumstances and priorities.

(Ready to Take the Next Step?)

If you're ready to make a move but are feeling unsure about where to begin, let's connect! We can assess your potential equity, discuss your timeline, and analyze the local market conditions to determine the most suitable path for you.

Contact me today to schedule a consultation and gain clarity on your real estate journey!

www.tyhomesforsale.com

3522131084

inayakelrealtor@gmail.com

Connect with me on Social Media:

https://www.facebook.com/tinayakelassociatebroker/

Categories

Recent Posts

GET MORE INFORMATION

Partner | Lic# 3002295