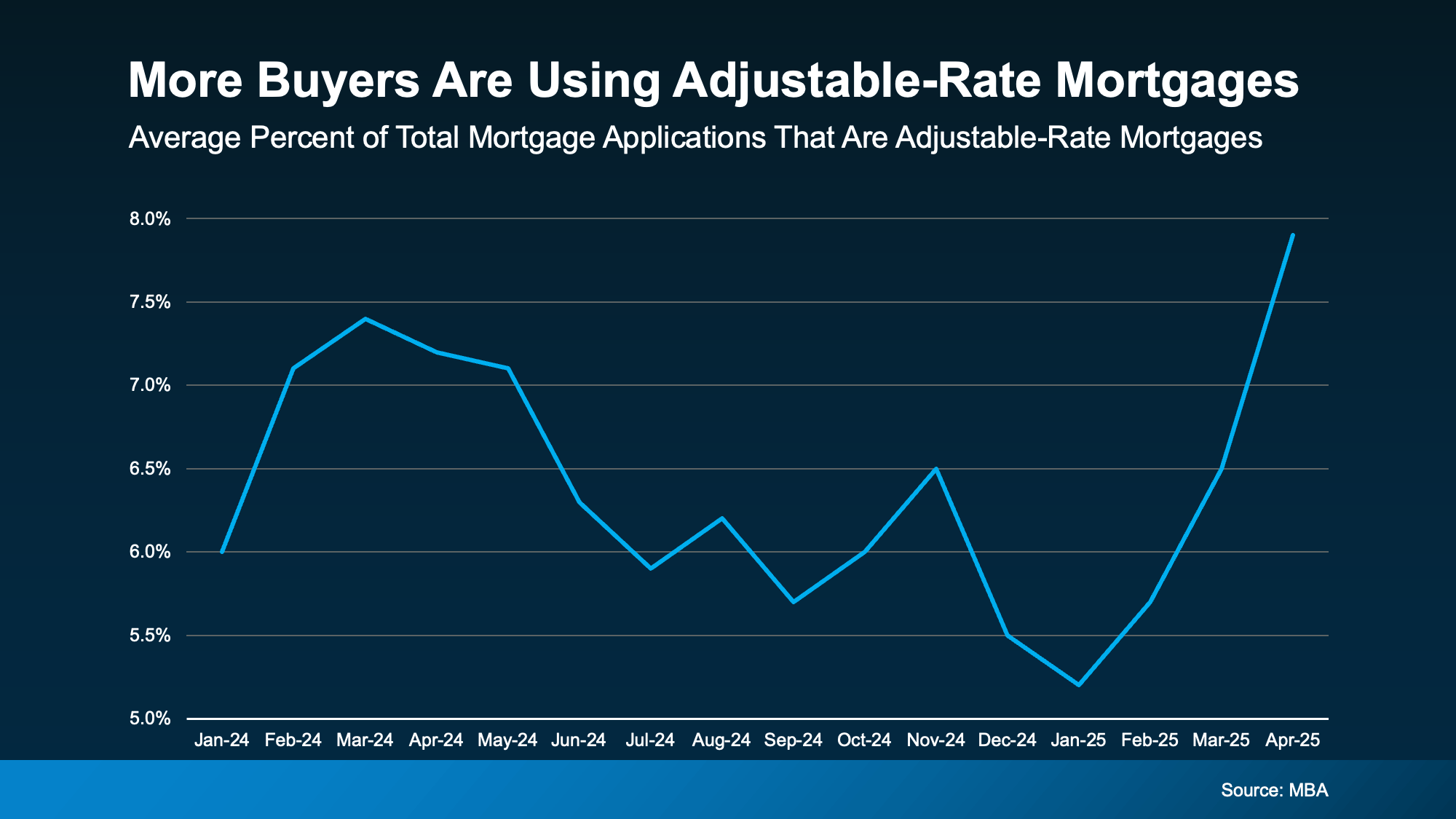

Thinking About an Adjustable-Rate Mortgage (ARM)?

You're not alone. As mortgage rates remain high, more buyers are turning to ARMs to make homeownership more affordable.

What’s an ARM?

With a fixed-rate mortgage, your interest rate never changes. But with an ARM, your rate starts lower for a few years—then adjusts based on market conditions.

✅ Why some buyers choose ARMs now:

Lower initial monthly payments

Helps qualify for more home

Great if you don’t plan to stay long-term

⚠️ But here’s the tradeoff:

That rate will adjust—up or down—after the initial fixed period. If you’re still in the home when it does, it could cost more (or save you money if rates fall).

Check out this recent trend ⬇️

ARMs aren't one-size-fits-all. But for the right buyer? They can be a smart financial tool.

Ready to explore if an ARM makes sense for you? I’ll connect you with a trusted local lender to walk you through your options. DM me “ARM” to start the conversation.

Categories

Recent Posts

GET MORE INFORMATION

Partner | Lic# 3002295